[A little surge in subscribers – from schools/colleges across the UK. Welcome.

I have recently completed an article for Geography Review, hopefully to be published in September 2024, about the changes taking place in economic globalisation. Essentially, the USA and several other countries are seeking to decouple themselves economically from China. This process isn’t straightforward, but involves what is known as reshoring, near-shoring, and ally (or friend) shoring. Here’s some information on these trends, with some supporting evidence….]

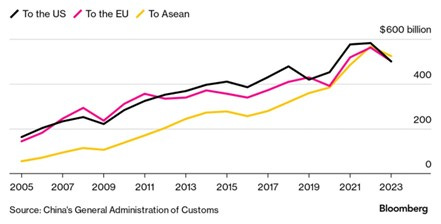

In 2023, China exported more to Southeast Asia than to the USA, highlighting the realignment of global trade that is happening as the relationship between Washington and Beijing frays over the Russia/Ukraine war and the tensions in the South China Sea and regarding Taiwan. The ten nations in the economic grouping ASEAN bought over $500 billion of Chinese goods last year, higher than the $500 billion worth sold to the US or the value of shipments to the EU (Figure 1).

Definitions

Reshoring is the process of bringing back production activities from overseas locations to the home country.

Near-shoring is a strategy that involves a manufacturing company transferring all or part of its operations to a nearby country. Mexico and Colombia are popular nearshore locations for US-based industries.

Ally-shoring refers to the process of sourcing essential materials, goods, and services among trusted democratic partners and allies.

Decoupling is the term for the outcome of all the above, with (in this case) the US economy being less dependent on China.

Figure 1. China export destinations

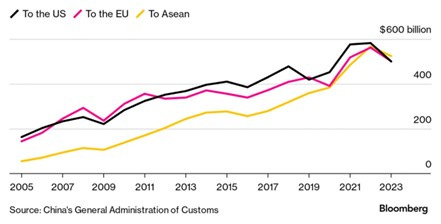

While the data show the decoupling that is happening between China and the US, there are some complications in this reduction of trade between the two nations. Chinese exports to Mexico are also increasing, with companies based there shipping some products on to the US, thereby avoiding US tariffs. Similarly, Chinese firms have increasingly been shipping goods to Vietnam and Thailand to be finished and then re-exported to the US and other developed nations (Figure 2).

Figure 2. Vietnam/Mexico trade origins/destinations

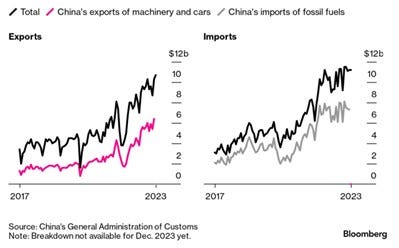

Conversely, Chinese trade with Russia shows that exports are up by almost 50% with imports rising by 13%. Chinese companies have taken advantage of foreign companies pulling out of Russia and so selling many more Chinese cars and other machinery. Chinese imports are also well above the level when Russia invaded Ukraine, with Beijing buying more oil and gas from Russia (Figure 3).

Figure 3. China/Russia trade