The 2025 Los Angeles fires, and the wider implications regarding insurance (2)

Part 2 – insurance implications

The economist, Ann Pettifor, has written that the January 2025 LA fires are ‘expected to be amongst the costliest disasters in U.S. history’ and have ‘deepened a crisis in the state’s home insurance market. Thousands of homes in the city had not had their insurance policies renewed and the rising costs of insurance and cancellations left many without adequate fire insurance cover.’

You can read her posts on the issue here and here.

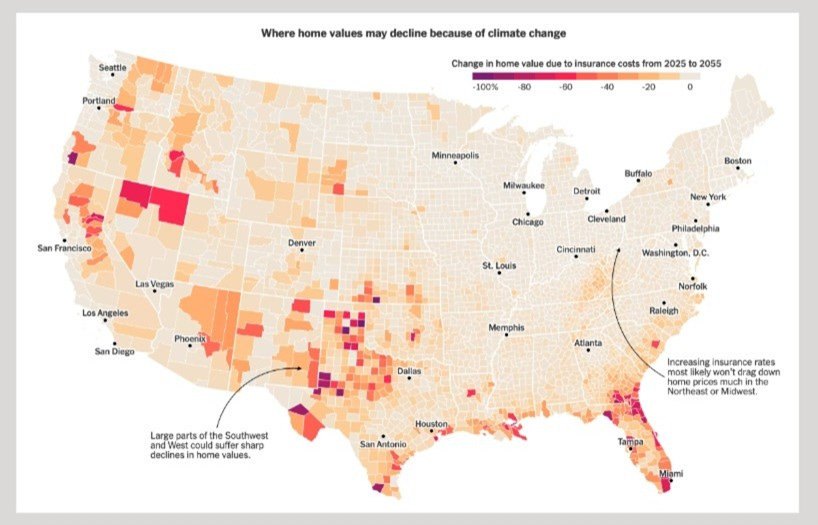

The fires, however, illustrate a wider problem facing homeowners across the USA. A study by the US climate-resilience think-tank First Street found that by 2055, nearly $1.5 trillion in US home values could be wiped out due to climate change, which is ‘predicted to destroy properties, drive communities out of high-risk areas, and lead to rising insurance premiums’. These losses will be concentrated in areas that are most at risk of extreme weather events, such as coastal Florida, California’s Central Valley, Nevada, Arizona and Texas, with some counties expected to experience net declines of up to 40% of their property values over the next 30 years (Figure 1). This trend is already underway, with insurance costs in many areas outpacing inflation and home appreciation rates.

Figure 1. Climate change and home values (USA)

(From a political perspective, it is worth noting that several of the insurance ‘at risk’ areas are Republican states. They are followers of Vice-President Trump, who is a strong climate change denier. It will be interesting to see if residents of these states modify their views in the light of their future home finances.)

Insurance issues in California

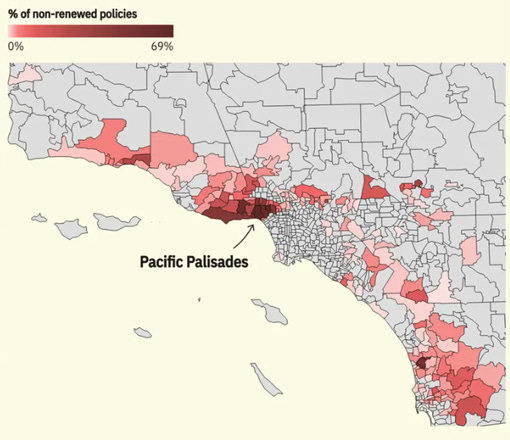

With the cost of damage caused by the wildfires in the Los Angeles area reaching an estimated $50 billion and growing, the disaster is exacerbating a continuing crisis in insurance costs and availability for residents of California. The insurance industry had already been raising insurance premiums or simply not renewing policies for homeowners before the current wave of wildfires in L.A. broke out. Some insurance companies had already stopped issuing any policies in California completely (Figure 2).

Figure 2. The LA zones hit the most by non-renewals by the US insurance company State Farm (2024)

Climate change has raised temperatures and increased dryness, thereby increasing the incidence of wildfires in a state also at risk of earthquake activity. In response to the loss of available private insurance, the state government of California established the FAIR plan, which provides insurance to California residents but with a maximum payout of $3 million for a property and its contents. For many families and their properties this sum is woefully inadequate.

And, there’s more in February 2025…

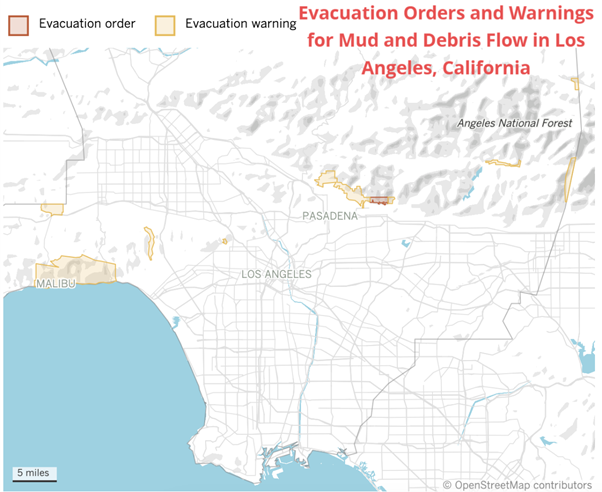

As southern California recovers from January’s devastating wildfires, recent heavy rains have resulted in areas of surface-water flooding, blocked roadways and mud piled up from around recent burn scars. The bare surfaces created by the wildfires have encouraged the formation of mudflows during periods of heavy and intense rainfall.

In Altadena, impacted by the Eaton fire, some vehicles were stuck in thick mud as rescue crews struggled to dig them out. In Malibu, an LA Fire Department member sustained minor injuries after his vehicle was swept into the ocean by a large debris flow.

Concerns linger over the potential for more mudslides and rockslides, which can occur long after rainfall has ended (Figure 3).

Figure 3. Evacuation orders and warnings (LA)

More detail on the potential for mudflows in the LA area and what can be done to prepare for them can be found here.