South and Southeast Asia (SASEA)

An important area of future economic development – adapted from Noah Smith

[This post is linked to the concept of decoupling. You can read a previous post written in January here.

I have also written more on decoupling in the latest edition of Geography Review, to be published in September 2024.]

One region of the world that is well-positioned to economically grow soon is the region identified as SASEA - an acronym for South Asia and Southeast Asia. South Asia includes India, Bangladesh, and Pakistan. Southeast Asia includes the island countries of Indonesia and the Philippines, the mainland countries of Vietnam, Thailand, and Myanmar, and the rich countries of Singapore and Malaysia.

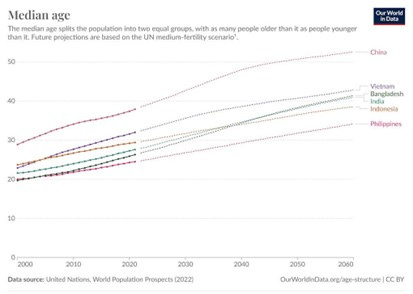

The population of SASEA is enormous; India is now bigger than China - the whole region contains a third of global population. SASEA has more people than Africa, and the whole ‘Western’ hemisphere. SASEA’s population is also still relatively young. Although all the region’s countries have experienced a fertility transition, they did so later than most others, and so their populations are projected to remain much younger than China’s for the next few decades (Figure 1).

Figure 1. Median ages (selected countries)

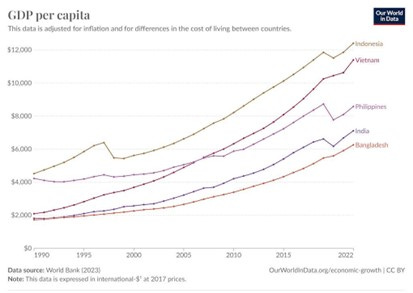

SASEA is growing economically too (Figure 2).

Figure 2. GDP per capita (selected countries)

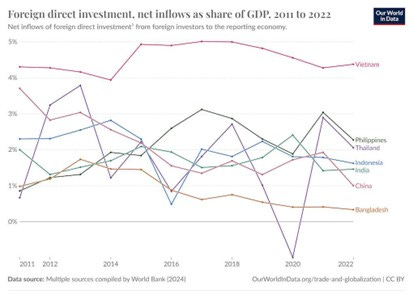

Most of these countries are also receiving net inflows of foreign direct investment (FDI) (Figure 3).

Figure 3. FDI as a share of GDP (2011-2022)

Although India is well-known for exports of services and Indonesia for exports of natural resources, manufactured goods also make up a significant percentage of their exports. For the Philippines, Bangladesh, and Vietnam, manufactured exports dominate.

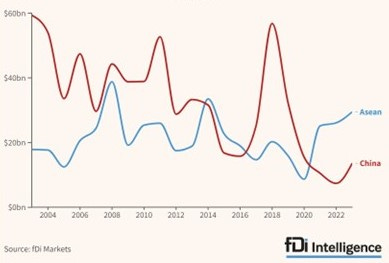

These countries are part of the new global trend of decoupling. Many transnational companies are seeking to de-risk from China. FDI into China declined by 28% in the first half of 2024. Many of their offices and factories are likely to return to the developed countries of Europe and the USA, though several will invest in Mexico and the SASEA. Southeast Asia has already overtaken China as a destination for manufacturing FDI from countries in the OECD (Figure 4).

Figure 4. Greenfield FDI by OECD-headquartered companies - China v. SASEA

Another factor is that tariffs have been introduced on Chinese-made imports by many countries around the world, especially the USA. A future Trump presidency is likely to see even more tariffs on Chinese goods to the USA. Notably, Apple has significantly expanded its iPhone manufacturing operations in India, and it is believed that Tesla may follow.

However, it is not just Western companies that are likely to invest in SASEA to avoid tariffs. Chinese companies such as BYD, Huawei and Xiaomi say they will too. Chinese manufacturers of EVs, and their batteries, are expected to shift production to other countries to avoid these tariffs. Economists predict a major shift to factories in Mexico, Vietnam or other parts of Southeast Asia. To some extent this has already started. Within SASEA, Vietnam is the primary beneficiary, but the more developed economies of Malaysia and Thailand are also important destinations for Chinese FDI (Figure 5). There has even been some Chinese FDI in India – a major economic rival.

Figure 5. Chinese investment into rival manufacturing hubs

Conclusion

Until recently, the Chinese government had been trying to onshore most of China’s production, making China a ‘make-everything country’. For decades, this strategy was a success. The agglomeration effects of China’s vast internal domestic market made most Chinese companies uninterested in offshoring their production.

Tariffs on Chinese exports, as well as other de-risking and friend-shoring policies, are now providing a push to counteract China’s homeward moves and spread industrialisation to other countries. The 2.5 billion people of SASEA require a great deal of FDI and rapid industrialisation to escape poverty and join the ranks of the advanced nations before their populations follow the developed world into ageing societies.